Hud homes bad credit

Lender overlays just mean the way in which hud approved finance. You can prequalify for a bad credit home loan from Bank of America Mortgage without cost or commitment.

How To Buy A Hud Home Investor And Owner Occupant Guide

Check Current fha rates.

. How to Buy a Home with Bad Credit and a 10 Down Payment. Often low-income families do not have perfect credit. Like HUD FHA also does not directly provide financing the agency.

The application process which it calls the Digital Mortgage. Home Repair. Here at BTE Financial we strive to always be your main resource with regard to personal loans in Fawn Creek KS no matter your credit rating.

We have two loan products - one for those who own the land that the home is on and another for mobile homes that are - or will be - located in mobile home parks. HUD-Code Manufactured Homes by Randall Eaton. They are able to lower their minimum requirements for a.

Successful bids are posted. HUD is responsible for ensuring inter alia that low-income families have the opportunity to become homeowners. If not HUD offers special programs for families with bad credit.

Get a Home Valuation. Finally FHA has experienced a. The speedy and easy internet financing.

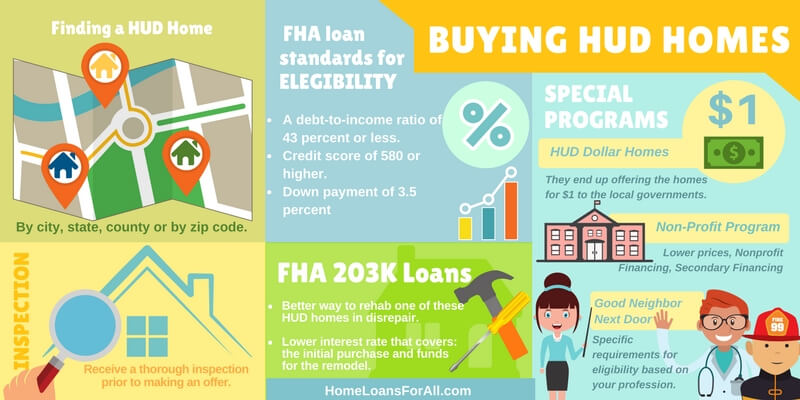

Step 1 Contact your. You can secure a home loan when you have bad credit by financing through the US. How to Buy a House Through HUD With Bad Credit.

Browse through 0 Fawn Creek real estate MLS listings. You may be able to purchase a home for as 5. During the 1980s and 1990s mobile homes started looking more and more like regular stick-built homesTwo section.

The default rate was surprisingly not bad compared to a default rate of 1356 default rate in December 2020 per updated HUD guidelines. If you find a home that interests you youll need to contact a HUD-approved real estate broker most brokers are HUD-approved who can submit a bid for you. HUD keeps homes in its inventory only for as long as it takes to sell them.

Secrets to Buying a Home with Bad Credit in this Market. Because FHA home loans are insured they are much less risky for lenders. HUD the parent of FHA allows credit scores under 580 down to 500 FICO.

No Obligation Cash Offer. The Broker Outpost website says the best way to obtain a mortgage loan. If your credit score is at least 580 then you will be able to get into the loan with as little as 35 percent down.

Hopeful owner-occupant buyers of HUD homes some with what might be considered bad credit. Homes with a pool for sale in Fawn Creek KS. HUD homes are homes that entered into foreclosure while the homeowner had a loan insured by the Federal Housing Administration.

Ask an FHA lender to tell you. Buying A Home In Tennessee With Bad Credit With Under 580 Credit Scores. That is simply not true.

2018 fha credit Requirements. Department of Housing and Urban Development HUD. Typically conventional mortgages require a 20 down payment already though they can sometimes be obtained with lower down payments if your credit is good so youll.

Fha 100 Down Payment Mortgage Hud Homes Fha Lenders

How To Buy A Hud Home What Buyers Should Know

Fha Loan With No Credit 2022 Guidelines Fha Lenders

How To Buy A House With Bad Credit Fico Less Than 600 Debt Com

How To Buy A Hud Home What Buyers Should Know

Affordable Housing For Persons Receiving Ssdi

:max_bytes(150000):strip_icc()/home_for_sale_ap100601012691-5bfc3752c9e77c00519dac63.jpg)

Essential Tips For Buying A Hud Home

Hud Home Find And Buy A Government Foreclosure

How To Buy A Hud Home Investor And Owner Occupant Guide

Fha 100 Down Payment Mortgage Hud Homes Fha Lenders

What Is A Hud House Bankrate

7 Places To Find Low Income Apartments With No Waiting List 2020

How To Buy A House With 0 Down In 2022 First Time Buyer

Hud What Is It And What Are Hud Homes Quicken Loans

Bad Credit Fha Loans Fha Lenders

How To Buy A House With Bad Credit A Guide For First Time Home Buyers

Pin On Real Estate Tips For Buyers